Our latest Milestones Report looks at the payment choices Australian make. It’s clear that the vast majority are moving away from cash and cheques faster than ever before. This is happening because widespread use of new technology combined with a strong preference for faster and more convenient payment options..

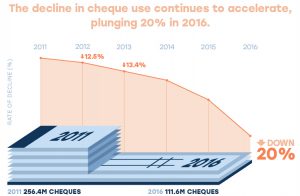

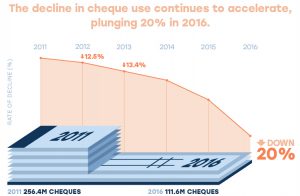

Cheque use in Australia plunged 20% to 111.6 million transactions in 2016, the largest drop ever recorded. The value of cheques fell by 6% after remaining flat in 2015 and dropping by less than 1% in 2014. Since 2011, cheque use has dropped by 56%.

Australia’s digital economy is also creating a less-cash society. In 2016, the number of ATM withdrawals dropped by 7.5% to 648.5 million. This follows a 5.5% drop in 2015 and 4.7% in 2014. Over the last five years, ATM withdrawals have dropped by 22%. In Australia, cash now accounts for just 37% of all payments..

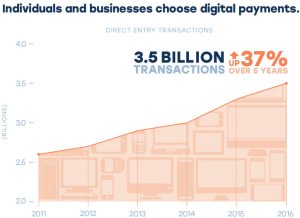

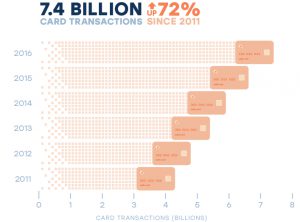

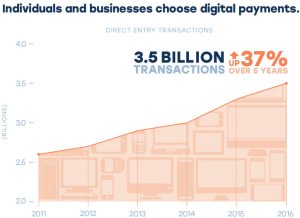

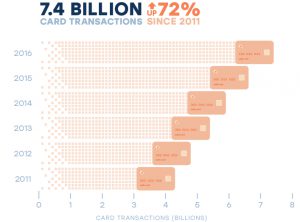

The decline in cheque use continues to accelerate as Australians embrace digital payments. Year-on-year the use of cards and direct entry transactions have shown continued strong growth. The number of card payments grew by 12.3% to 7.4 billion in 2016, and direct entry transaction by 8.6% to 3.5 billion. Over the last five years, card transactions grew by 72% and direct entry by 37%.

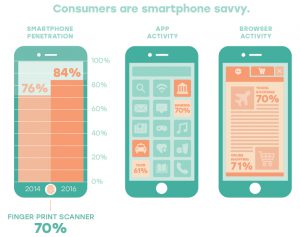

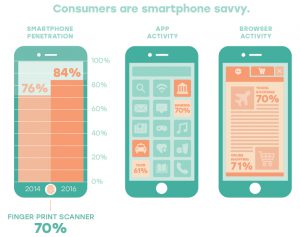

Increased smartphone penetration is a contributing factor. In 2016 smartphone penetration reached 84%, up from 76% in 2014..

Online retail spending continues to grow and was estimated to reach $21.6 billion in 2016. Domestic spending by older Australians increased by 8.7% for those in the 55-64 age group, and 7.5% for the 65+.

International payment trends make for interesting comparisons on the domestic market. Sweden is well on the way to becoming the first cashless society with only 15% of payments made using cash, whereas in Germany, cash use is more resilient. The Report looks at how governments Sweden, India and Equador are exploring the economic and regulatory implications of a less-cash society.

The Report also tracks progress on initiatives supporting Australia’s transition to the digital economy including the industry’s New Payments Platform and Australian Payments Plan.

Download the Infographic. To read the full Milestones Report May 2017, click here.

SaveSave