Change is pretty well the only constant when it comes to consumer payments. In Australia, we have seen a rapid uptake in contactless card use as well as increased use of online payments. Conversely, we have seen a rapid decline in personal cheque use as well as an ever-diminishing use of cash.

Monitoring changing payment usage can be notoriously difficult. The Reserve Bank of Australia (RBA) and APCA collect and publish statistics from industry participants on cheques, cards and electronic payments as well as the number of ATMs and POS devices. However, other types of usage such as cash use and the split between card-present (point-of-sale) and card-not-present (internet, telephone and mail) transactions are more difficult to track. Consumers and merchants don’t regularly record or report their own payments activity – meaning we only get a partial picture of how payments use is evolving.

APCA has made its own contributions to filling this knowledge gap, for example, last year we released our Evolution of Cash Report, where we found contactless rapidly displacing cash at point of sale.

Similarly in mid-2014, the RBA released “The Changing Way We Pay: Trends in Consumer Payments”. The RBA Report is based on consumer survey work undertaken in 2013 which sought to track consumer payments use in Australia. The RBA has previously done consumer payments surveys in 2007 and 2010. With three sets of historical data, we can now track trends in consumer payments use.

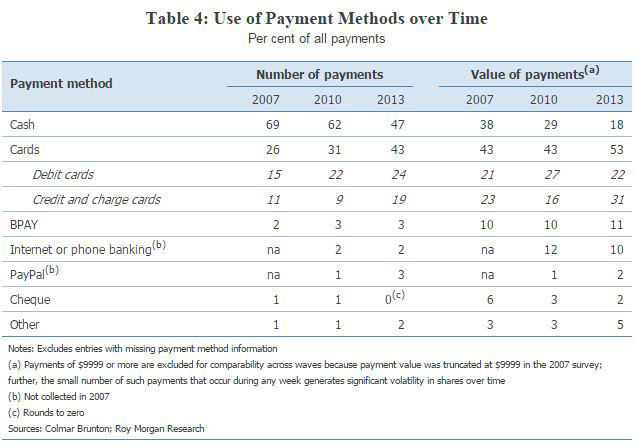

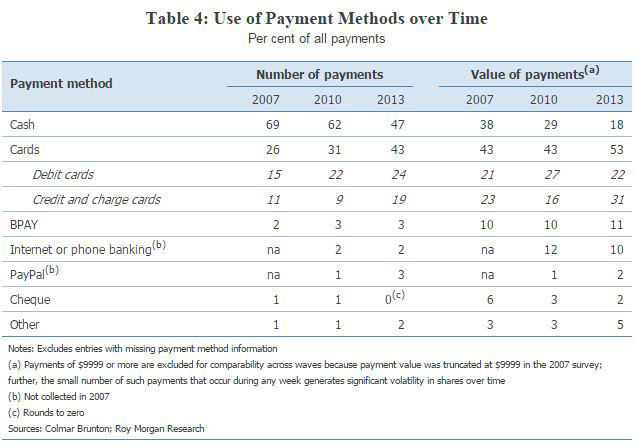

Between 2007 and 2013, Australia experienced a dramatic decline in cash use from 69 per cent of consumer payments to 47 per cent.

Source: RBA The Changing Way We Pay: Trends in Consumer Payments

The most recent RBA report contains a wealth of insights into consumer payments, particularly around the volume and value of particular payment methods and where people use those methods. Some of these findings reflect what many of us probably do ourselves or observe daily – that Australians are comfortable with a wide range of payment methods. We might pay our household bills with BPAY, use our credit card for higher-ticket items like holidays and electrical goods, pull out our debit card to purchase petrol and groceries, and use cash for our shout at the pub!

The release of supplementary data from the consumer survey in January 2015 was a pleasant surprise. This additional data from the 2013 consumer survey has allowed us to examine particular issues, for instance the relative size of card-not-present transactions.

The supplementary data, some of which is reproduced below, notes that for debit cards, card-not-present represents one-tenth of volume but nearly one-quarter of value, strongly suggesting debit card card-not-present transactions are not insignificant.

For credit cards, about 20 per cent of transactions by volume are card-not-present while card-not-present transactions represent 40 per cent of credit card values!

Table 3a – Per cent of the number of payments, by payment method and payment channel

| Payment method | In person | Internet | Smartphone/ SMS | Telephone | Mail |

|---|

| Debit card | 91 % | 8 % | 1 % | 1 % | 0 % |

| Credit Card | 79 % | 16 % | 1 % | 3 % | 0 % |

Table 3b – Per cent of the value of payments, by payment method and payment channel

| Payment Method | In person | Internet | Smartphone/ SMS | Telephone | Mail |

|---|

| Debit Card | 77 % | 19 % | 1 % | 3 % | 0 % |

| Credit Card | 57 % | 31 % | 1 % | 11 % | 0 % |

Source: RBA data collected by Colmar Brunton | Figures may not sum to 100 due to rounding

Payments only; excludes transfers | Payments of $9999 or more are excluded

These figures place card-not-present transactions into pretty sharp relief, particularly as recent increases in payments fraud have been primarily in the card-not-present space. Using cards for online purchases is no longer a rare occurrence or occasional activity – it has now one of the main ways we spend on our credit cards. And as more of us take advantage of the choice and convenience that card payments and online shopping provides, we will also need to take care and be mindful of the potential risks. So follow the simple steps including only shop on secure sites (“look for the padlock”), keep your PC security software up to date, use your financial institution’s fraud security tools when prompted, monitor your statements and report suspicious transactions to your financial institution.