From Sydney to Silicon Valley

On a recent visit to the United States, I was fortunate enough to spend some time with a variety of Silicon Valley firms involved in the payments industry. I was struck by the similarities and differences in payments between the US and Australia.

The future of payments

Most obviously, the consumer experience is very different at point-of-sale. In contrast to the ubiquity of chip and PIN, and of contactless, that we’re used to in Australia, the US is only now rolling out chip – and in its case, chip and sign rather than chip and PIN. Customers are finding this a difficult migration, with some complaining both about the time chip payments take in the US and about the sometimes-confusing customer experience.

In contrast, peer-to-peer payments are much more evolved in the US with the uptake of Venmo and the recent launch of Zelle.

And online payments processing is very developed in the US, with the likes of Stripe, WePay and Braintree using open APIs to make it straightforward for merchants to accept payments across multiple channels, even including newer, non-domestic channels such as WeChat and Alipay.

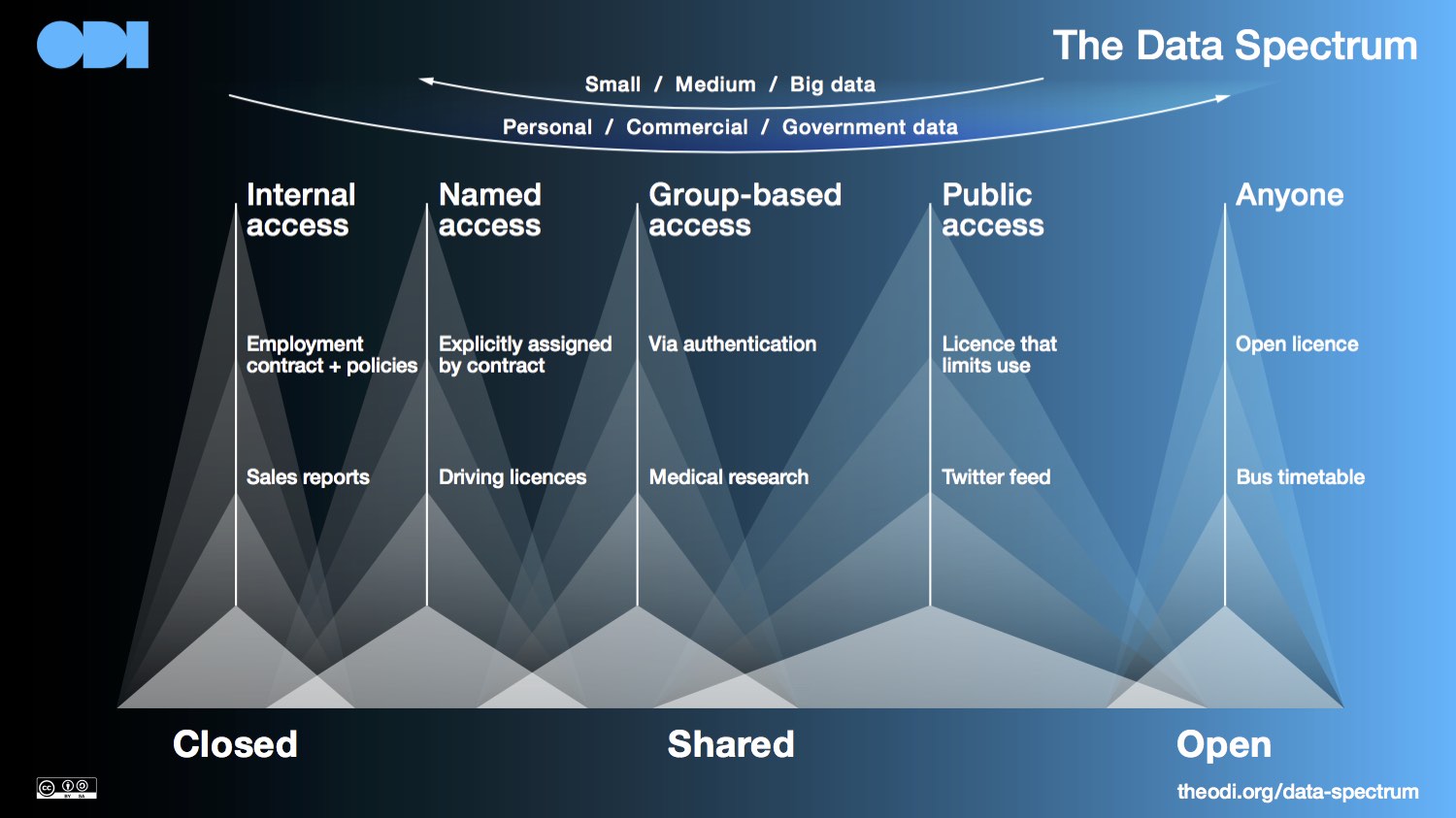

The use of open APIs to assist online merchants is one example of payments becoming ever more embedded, less visible and frictionless. More broadly, this is a focus for the large technology companies as they seek to reduce the friction customers experience in purchasing goods from online retailers including on mobile: if payment can be made frictionless, then customers will remain on technology platforms, including social media, and won’t abandon their purchases.

Emerging issues, emerging solutions

As chip rolls-out at point-of-sale, the US payments industry is well aware of the likely increase in card-not-present (CNP) fraud, already a focus for us in Australia. Some estimates suggest CNP fraud could almost double by 2020 in the US.

But excitingly, emerging payments technologies will help here, be that in the form of digital wallets, online baskets, and biometrics associated with both. And that’s exciting both for the US and for us here in Australia. Almost as exciting as actually sighting Mark Zuckerberg at the Facebook offices!