Perspectives on the Australian Payments Plan

Last month’s release of the Australian Payments Plan (APP) signals big changes for the Australian economy – but what does it actually mean?

We spoke to Bruce Mansfield, managing director of eftpos Payments Australia Ltd – and a member of the Payments Council committee that worked closely on the plan – about the future of payments and why the industry needs to work together to meet the needs of Australians in the digital economy…

Why do we need the APP?

BM: We need the Australian Payments Plan because we are living in a period of great technological and social change and it’s very important that the payments industry keeps up with the pace.

This change is being driven by significant trends such as the extent to which everyone is connected, the opening up of networks and the layering of services on these connected networks.

What risks does Australia face given the rapid developments in payments technology?

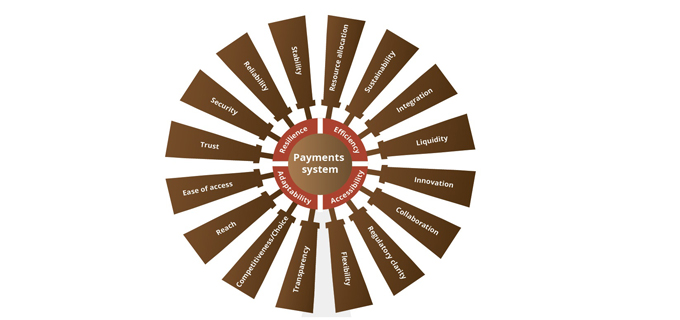

BM: Every day we read about new digital products that impact our lives and it’s important that as an industry we ensure that these developments don’t take away from the desirable characteristics of our payments system, specifically resilience; efficiency; accessibility, and adaptability.

These characteristics are all important because they are about trust, and it’s fundamental that Australians are able to trust the payments system. Trust comes from a payments system that is secure, reliable, accessible and stable.

The plan was put together based on widespread consultation that provided a clear view of industry-wide issues and developments.

For example, the plan’s focus on standards and interoperability is key to having a fair and open system, along with a consistent approach to issues such as cyber-security and tokenisation across the industry.

This is the first time the industry has agreed on a shared vision – how well do you anticipate the industry will collaborate with each other?

BM: The interconnected nature of the payments system makes collaboration essential when we are dealing with significant global developments. With that in mind, the Australian Payments Plan looks at a series of key issues that can only be dealt with effectively if the industry addresses them through a coordinated, collaborative approach.

Accessibility is also very important because it ensures we have access to new platforms and that choice is maintained for consumers and merchants, particularly as we move towards new platforms like mobile.

Importantly, eftpos was established through industry collaboration to ensure that we all had access to a simple and secure electronic payment network that linked financial institutions, merchants and consumers. It is a great example of what can be achieved when the payments industry works together.